|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Top Refinance Banks: Expert Tips and AdviceRefinancing your mortgage can be a smart financial decision, potentially lowering your interest rate or monthly payment. When considering a refinance, choosing the right bank is crucial. This guide will help you understand the top refinance banks and what makes them stand out. Factors to Consider When Choosing a Refinance BankInterest RatesInterest rates are a primary consideration. Even a slight decrease can result in significant savings over the loan term. Customer ServiceQuality customer service is vital. You want a bank that communicates clearly and responds promptly to your inquiries.

Fees and CostsRefinancing often involves fees. Some banks offer no-closing-cost options, which might be worth exploring. Always ask for a detailed breakdown of costs. Top Refinance Banks and Their OfferingsBank ABank A is known for competitive rates and exceptional customer service. They offer various refinancing programs tailored to different needs. Bank BWith a strong online presence, Bank B provides easy access to information and a seamless online application process. Discover more about the best home refinance lenders for a wider perspective. Bank CBank C is popular for its flexible terms and customer-friendly policies, making it a top choice for many homeowners. Steps to Refinancing Your Home

For those looking to understand more about available options, explore the best home refinance programs to find what suits your needs best. FAQs About Refinancing BanksWhat is the best time to refinance?The best time to refinance is when interest rates are lower than your current rate, and you plan to stay in your home long enough to recoup closing costs. Can I refinance with a different bank?Yes, you can refinance with a different bank. It's essential to compare offers from multiple lenders to ensure you get the best deal. Are there any risks in refinancing?Risks include extending your loan term, which could increase total interest paid, and potential fees that might outweigh savings. https://www.credible.com/mortgage/best-fha-streamline-refinance-lenders

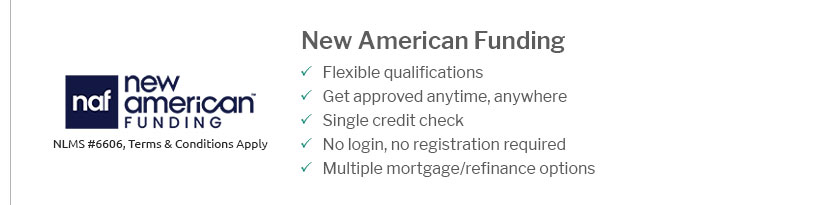

Best FHA streamline refinance lenders - Rocket Mortgage - Freedom Mortgage - Guaranteed Rate - Caliber Home Loans - Pennymac - loanDepot - New American Funding. https://money.com/best-mortgage-refinance/

Bank of America Best for Member Discounts; Better Best for Fast Closing Time; loanDepot Best for Online Mortgage Refinancing; Nationwide ... https://www.bankofamerica.com/mortgage/refinance/

Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you.

|

|---|